- Morning Crush

- Posts

- Silicon Valley Bank Fiasco 🔥

Silicon Valley Bank Fiasco 🔥

Don't Let Your Bank Fail You: How to Evaluate Your Financial Institution

Together With…

Mercury.com (affiliate) Banking for Startups. Scale with FDIC-insured bank accounts, debit and credit cards, and 3-click payment flows.

Tired of reading? Catch the morning crush… video style!

Happy Wednesday! Buckle up as we take a ride through the financial district of field service insights, where the currency is experience and interest rates are sky-high!

Today’s Topic’s:

📰 News Nuggets 🐤

💖 Inspiration Ignition 🔥

🏈 Up Your Game - Cashflow Champion 💰

🤖 Artificial Advantage 🦾

🤣 Fun-Tastic Finds 🎉

FEATURED STORY

The Silicon Valley Bank Story : What it Means for Your Business

🎵 My Bank is on FIRE! 🎵 - Alicia Keys (sort of.)

Once upon a time, there was a bank called Silicon Valley Bank. They put their customer’s deposits into “safe”, long dated assets because the Fed told them post Covid-inflation was temporary.

This was not true. - who knew printing trillions of dollars overnight would cause inflation, right? 🤦♂️

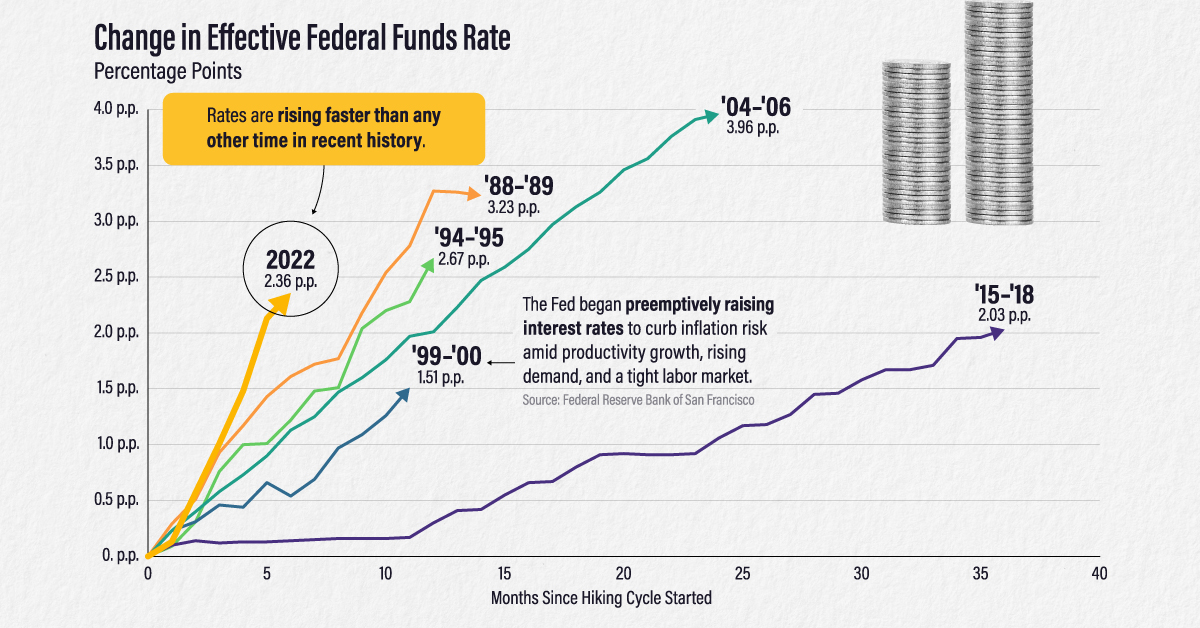

The Fed was forced to raise interest rates faster than any other time in history.

This rapid increase caused SBV’s long dated assets to quickly lose value and they were unable or incapable of pivoting fast enough. They were effectively insolvent.

Some of the smartest people in the world saw this and decided to pull their money out of the banks. Then more did, then more did, then more did.

This is called a bank run. 💸

This bank run happened very quickly because today everyone has access to a bank teller in their pocket. 🤳 The government had to quickly step in and guarantee SBV’s customer deposits to prevent other bank runs.

This is called a bailout. 💰 - can’t call it a bailout because it doesn’t poll well. 📉

In today’s article, we give 5 things to consider when evaluating your future or current banking relationships.

📰 NEWS NUGGETS 🐤

Fresh Finds in Home Services

Profit Roadmap podcast 🎧 by Xplor relaunched. - 📰 Press Release

WorkWave sizzles with an 84% YoY revenue growth in Fiscal Year 2022, boasting a 119% net retention rate as a top SaaS solution for field service businesses! 💰📈

80/20 Rule… Rules! - Study shows 80% of high performing Field Services companies are utilizing an 🤖 Artificial Advantage 🦾 with AI.

Plunkett's Pest Control unites with Mission Pest Management, expanding their reach in Greenville and Pittsburgh, in a delightful alliance of service-driven, like-minded companies. - PCTOnline.com

April is National Pest Management Month - Cheers 🥂

💖 INSPIRATION IGNITION 🔥

Light Sparks of Creativity & Motivation

“A bank is a place that will lend you money if you can prove you don’t need it.”

🏈 UP YOUR GAME - Cashflow Champion 💰

Elevate Your Financial Game - Tips & Tools

Hey there, Cashflow Champions! It's me, Budget Brad, and I'm stoked to share my latest Up Your Game - 8 QuickBooks Setup Tips to Ignore at Your Own Risk! ⚠️

This article is packed with important QuickBooks tips tailored specifically for field service professionals like you – whether you're dominating in pest control, landscaping, or pool services.

You'll learn how to lay a rock-solid foundation for your company file, customize your chart of accounts, and sync your bank accounts for hassle-free automation.

But that's not all! I'll also walk you through the secrets of job costing, online invoicing, and class tracking, so you can get a firm grip on your profitability and make data-driven decisions.

And, of course, I've got you covered with payroll management and regular reconciliation tips to keep your team happy and your books in check.

So, my fellow Cashflow Champions, if you're ready to take your field service business finances to the next level, click over to read this article.

Your business will thank you for it, and you'll be well on your way to becoming an unstoppable force in the field service world.

Let's get that cash flow rolling, and as always, happy hustling! 💸💪

Finance Skills by Budget Brad

🤖 ARTIFICIAL ADVANTAGE 🦾

Supercharge Your Business with AI

I am old enough to remember TBTI - Time Before The Internet 👴

I don’t want you to have your own Bryant Gumbel / Katie Couric “What is AI?” moment. 🤣

AI will be as impactful as the Internet was back in the 90’s. That is why each Wednesday we will feature a section devoted to helping you navigate this rapidly evolving world to your 🤖 Artificial Advantage 🥇.

To get the ball rolling, here are just a few areas it will impact:

Customer Service Automation: AI-powered chatbots will answer customer questions and help with standard tasks such as scheduling.

Predictive Maintenance: AI-powered sensors will be built into every product to detecting potential issues before they cause damage.

Workforce Optimization: Analyze employee productivity, job assignments, and scheduling to reduce labor costs.

Inventory Management: Reduce waste and storage costs by identifying trends and demand forecasting.

Dispatch and Route Optimization: Ensuring the right technician gets to each job in the most efficient manner.

Marketing Functions: Copywriting, SEO, Review Monitoring & Responses, Advertising, Design, Landing Pages, Workflows, Testing and more.

We will be doing deeper dives into many of these to help you better understand how you could give your company an 🤖 Artificial Advantage 🥇.

Why not spread the superhero serum and inject your coworkers with this information by referring them to join the newsletter?

🤣 FUN-TASTIC FINDS 🎉

Grins, Or Your Money Back

Yea! it’s SPRINGTIME!

Fowler Pest Control

Fowler, IN— Rural Indexing Project (@ruralindexing)

4:45 PM • Apr 1, 2023

🙋♂️ CLOSING CRUSH 😍

Just like a bank run, service calls can be unpredictable, so stay ahead of the game and keep your customers' trust account full – now go crush it today!